→ Attention UAE Property Investors looking to grow generational wealth in UK Property:

In less than 28 days Laine was on his way to £4k a month Net Profit in his first year, thanks to two strategic property investments. With a projected 50%+ ROI and most of his money back out, he’s ready to reinvest and keep growing next year.

In just 4 years, we’ve unlocked over £4.8 million in passive rental income and built generational wealth for over 200 international investors

What We Did For Laine

Within 4 weeks of his initial call with us...

-

We found Laine 2x Properties, Both were agreed sale Below Market Value of £50k combined;

-

Our build team is turning them into High Return On Investment HMO's with Projected 50%+ ROI;

-

Very little of his own money left in the deal after refinancing, less than £80k;

-

Projected £4k a month NET Income after all costs, even with High Interest rates currently, which will likely be circa £5.5k Net profit in 2 years;

-

Our management company, Pineapple-Living will manage the lettings, making sure his £203k+ a year of rental income is maximised.

Bookmark this page for updates as the project unfolds!

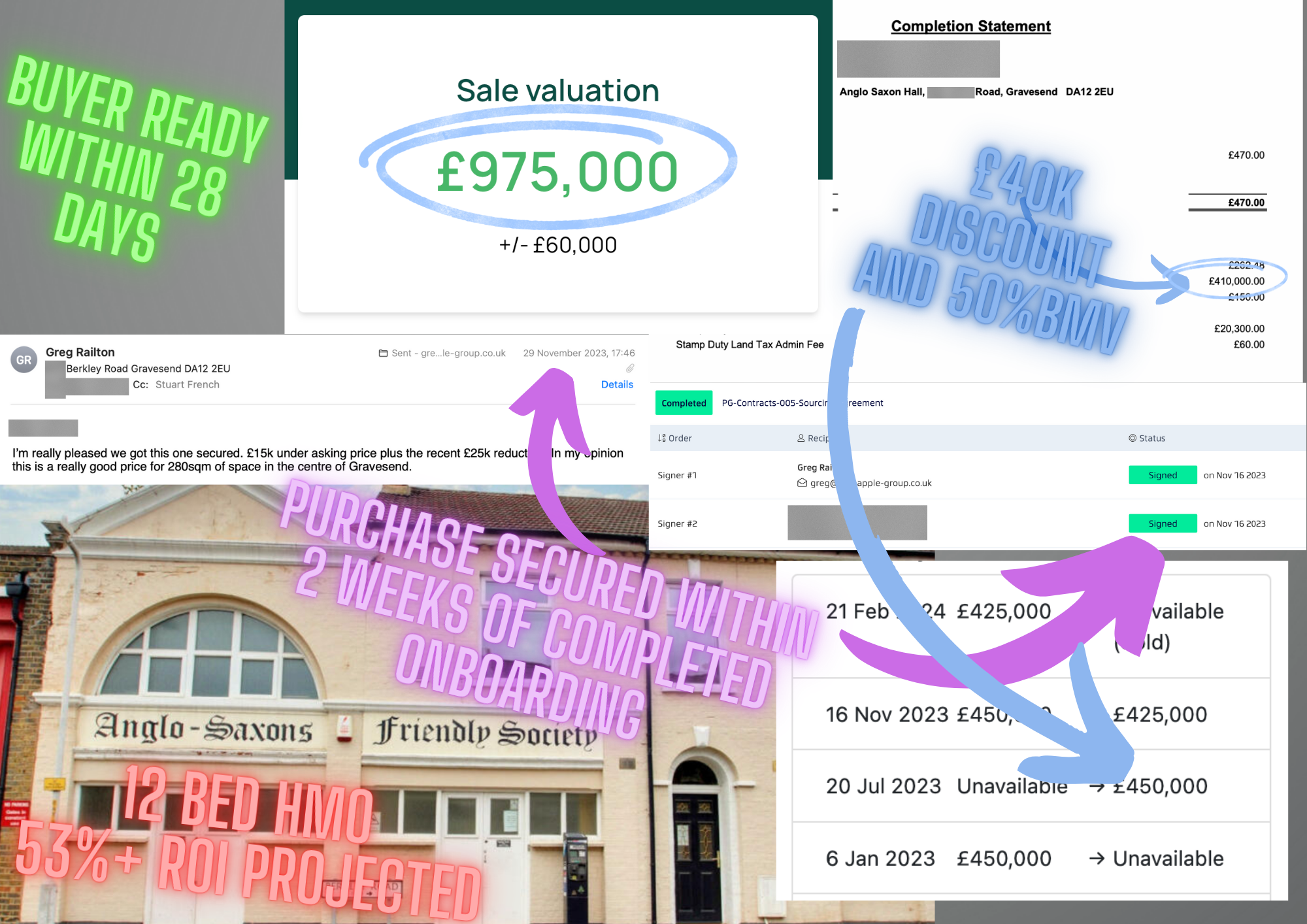

Berkley Rd - Story

Number 2&3 Berkley Rd was a commercial space, in a prime area for HMO.

Set over a genuinely huge floorplan, the property had been on the market for YEARS, waiting for a sale. With previous sales falling through, the owners were keen to complete a sale, and although the Price per square meter value was above £900k, we were able to secure the property for £410k. See the completion statement at the bottom of the page!

Berkley Rd - Purchase Images

Berkley Rd - Client intro to the deal

Watch the video of us walking Laine through the numbers to this deal.

We take great care to communicate the whole scheme and shed light on every element that we can, so that when the client decides to buy, they know as much as possible and can make an informed choice!

Would you have bought this one?

Berkley Rd - Numbers & Floorplan

We had a detailed site survey carried out on the property, given it's size and complexity, to assist the Architects by giving them millimetre accurate, laser data-drawn plans.

The mission is to turn this disused commercial space, into a 10-12 bedroom House of Multiple Occupancy with all en-suite rooms, with a GDV of £1M+ and a gross rental income of £97.2k+ annually, depending on final scheme and what we do with the second side of the building.

As the project unfolds on this one, the numbers keep getting better and better with interest rates dropping!

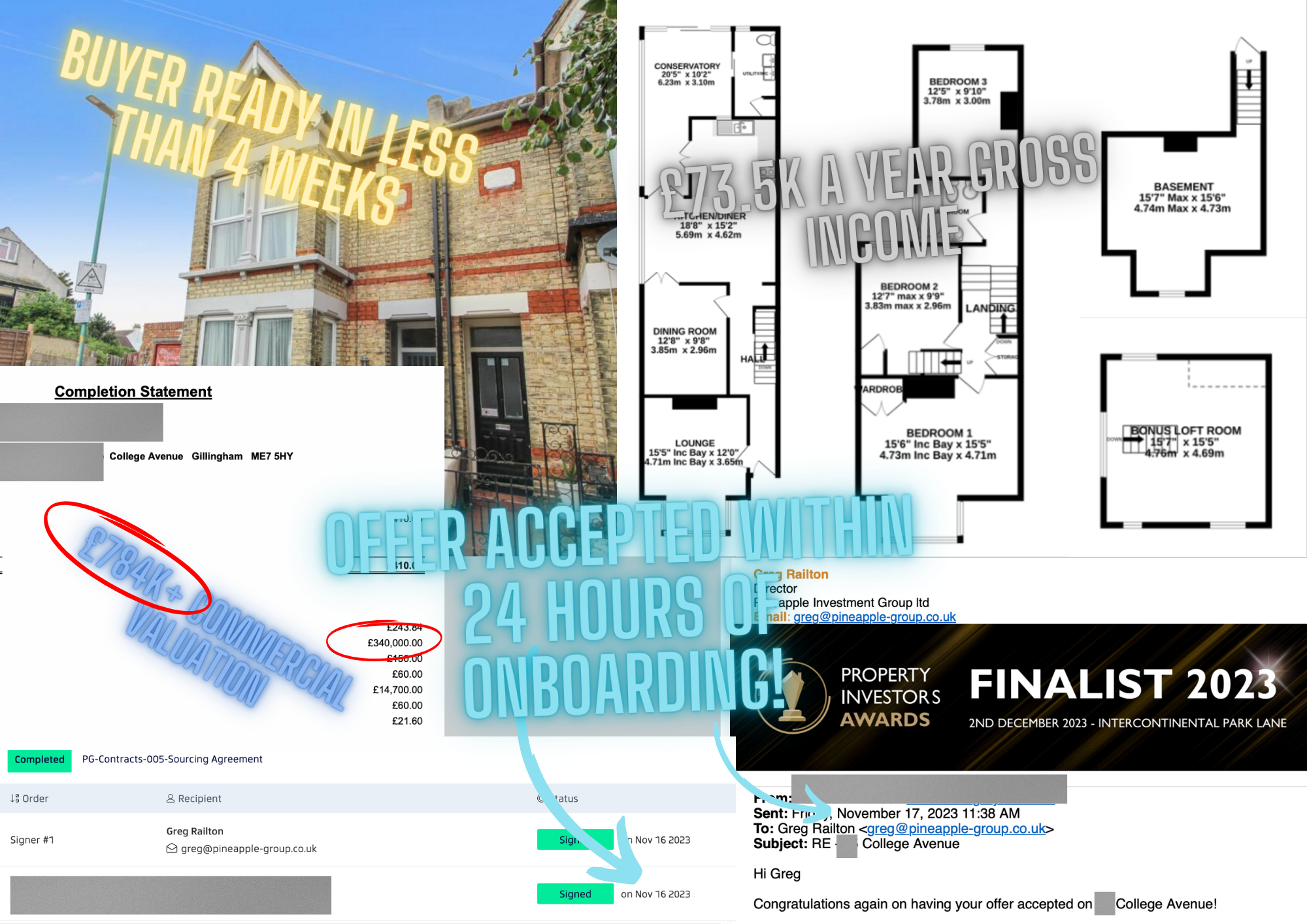

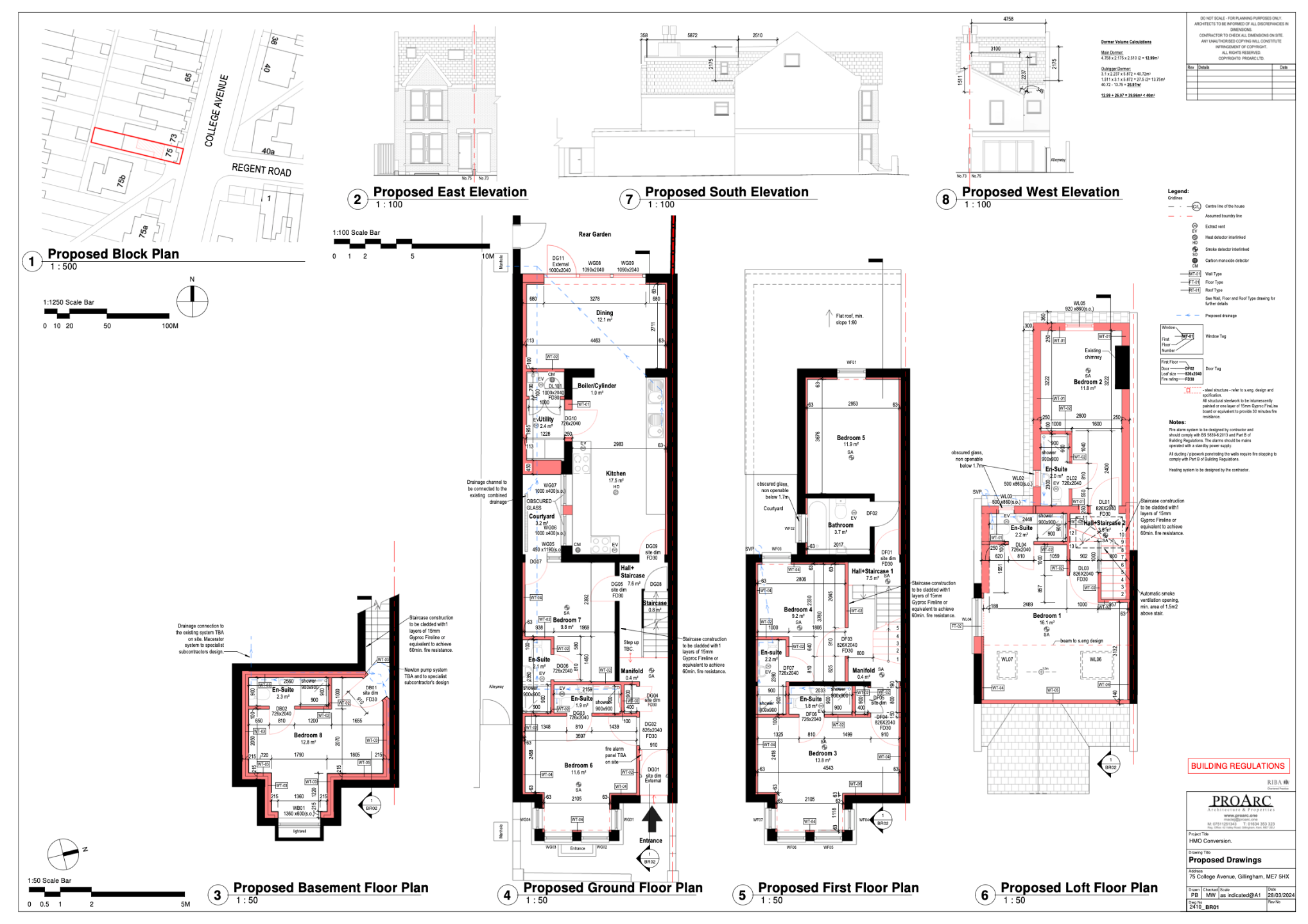

College Ave - Story

College Avenue is a 4 bed residential property in a HMO hotspot.

Being of significant size and width, as well as the end-of-terrace, this was a prime opportunity to develop the property into a Luxury 8 Bedroom HMO, all with en-suite bathrooms.

As the property had recently suffered a failed-sale, due to a previous buyer not getting their mortgage, the owners were open to a reduced offer in order to complete the sale with certainty.

We were able to use our experience in spotting motivated sellers and knowledge of the true value of the property as a HMO investment to secure a great investment for Laine.

College Ave - Purchase Images

College Ave - Video

In this video, we walk through the deal for Laine, showing him the numbers, discussing rental rates, commercial valuations, mortgage rates, and the projected cashflow and ROI at the end.

Going into a deal being sure that you're making money is key to success so we take great care to accurately build a picture for our clients.

It also helps that we've done this many times before in the same area, so we can be extra accurate! Take a look!

College Ave - Numbers & Floorplan

Agreed sale price was £340k, with a GDV of £735k - £784k and ROI of between 35% and 45% depending on interest rates and valuation.

This property will be a reasonably high cashflow 8 Bed-8 Bath HMO, delivering £73,500 in gross rental income or between £1600 and £2100 a month NET profit (after all costs), depending on interest rates on delivery.

As interest rates further reduce, the returns will increase, demonstrating how buying in a market when others are fearful, is how to make the biggest long term impact on your wealth.

Laine's Deals